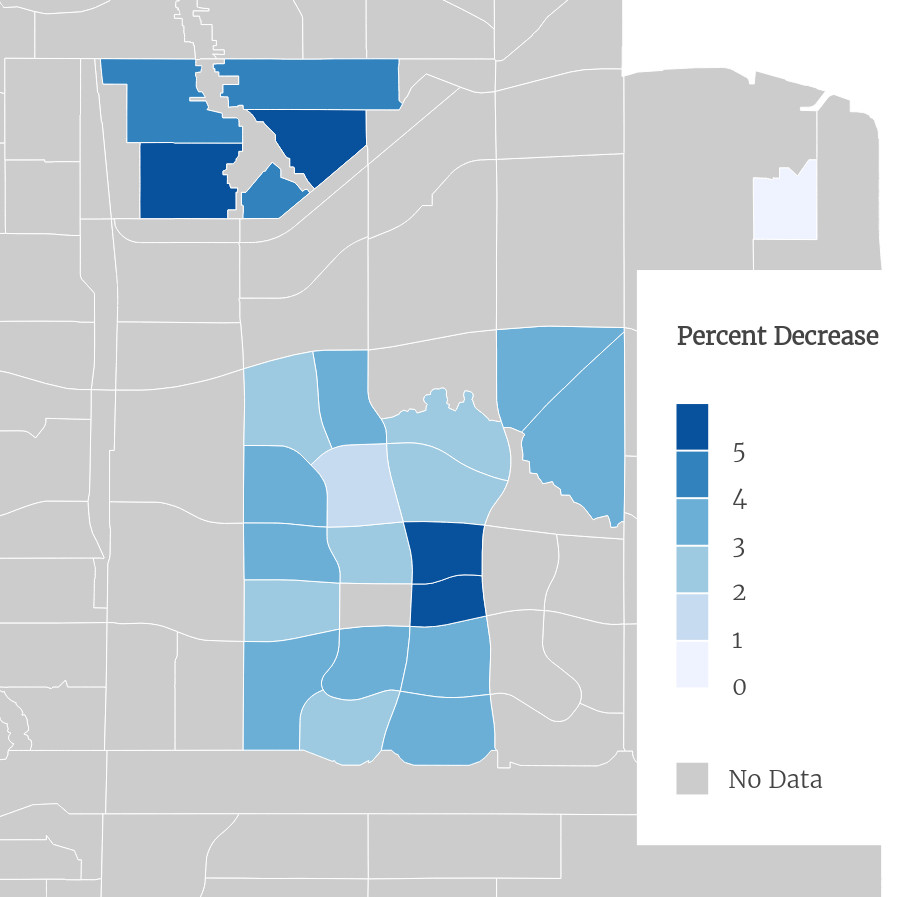

A soft economy and extra housing stock over the past year as led to an average decrease of 2.7% citywide this year for single family homes.

Some inner city areas saw a modest increase in their property assessments; the areas of Central McDougall and Boyle Street saw significant increases at 12% and 10.2% respectively.

But in Ward 11, all of our communities decreased in assessed value! Except for Maple Ridge, which is holding steady.

The blue represents both property tax decreases, and temperatures this week

The community with the steepest drop in single-family property assessments was Avonmore at 5.3%. That puts Avonmore's median assessment at 382,500, down $21,500 from last year. Though Mill Woods Town Centre and Tawa had sharp decreases at 4.9% and 5.2% respectively, there are very few single-family homes in those neighbourhoods.

The second place neighbourhood for loss of single-family property value in this assessment period hits me close to home in Hazeldean at a 4.9% decrease.

Maple Ridge is holding steady, with their median assessment equalling $69,500, the same as the previous year.

It's important to remember that a decrease in the assessed value of your home does not necessarily mean you'll see a decrease in the amount of taxes paid each year. The first step is council will determine a budget and then your share of taxes is determined based on the assessed value of your home compared to the total assessed value of all homes in the city.

Since the average decrease in the city was 2.7%, if your property decreased in value more than that, you'll bear a smaller proportion of the overall taxes in the city. Conversely, if the value of your property decreased from 0-2%, or even increased, then you can expect to bear a larger share of the tax burden this year.

The City of Edmonton also shares lots of information on their assessment webpage